To post minor journal adjustments from within your Bank Reconciliation program:

Micronet displays the Bank Reconciliation screen.

Select the transaction to be adjusted for in the Bank Reconciliation screen.

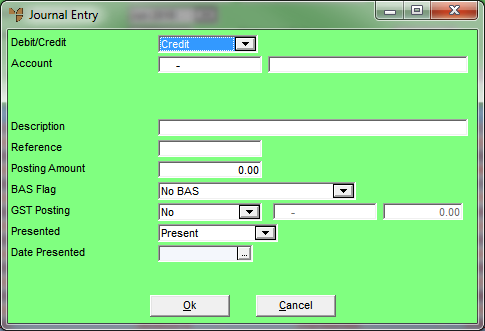

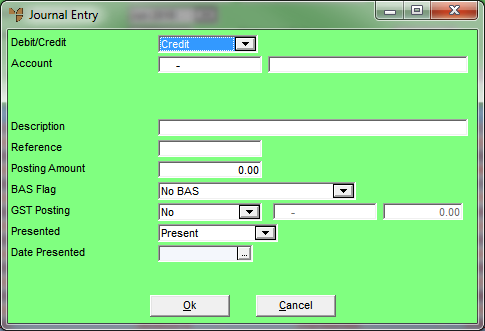

Micronet displays the Journal Entry screen.

|

|

|

Technical Tip If the transaction selected is a consolidated amount forming more than one transaction, Micronet displays the Select Entry screen.

Select the transaction to adjust. |

Micronet posts the bank account side of the GL journal. Select a debit or credit for the other side of the transaction. For example, to reduce an expense payment in the bank reconciliation, select Credit to reduce the expense account; Micronet automatically debits the Bank account for the same amount.

Micronet automatically posts the same amount against the Bank account.

|

|

Field |

Value |

|

|

BAS Flag |

Micronet displays the BAS flag entered against the selected expense account. However, you can change this if required to process the transaction with an alternative BAS section, e.g. to G14- No GST. |

|

|

GST Posting |

Select GST Input Credit account or GST Collected account to have 1/11 GST calculated on the transaction. The other side of this journal entry is automatically posted to the Bank Account being reconciled. |